tax benefit rules for trusts

We Offer Best In Class CPE Courses For Tax Professionals CPAs EAs CRTPs Attorneys. As a result of.

Kitces Avoid Big Tax Bills With This Special Trust Nasdaq

For tax purposes the key distinction in a family trust is whether it qualifies as a.

. In 2022 the federal government taxes. Trusts are traditionally used for minimizing estate taxes and can offer other. The trustee will need to file a US.

New Tax Rules for US. Chat With A Trust Will Specialist. Received no tax benefit from the overpayment of 750 in state income tax in 2018.

It shouldnt but it is. Ad Real Estate Family Law Estate Planning Business Forms and Power of Attorney Forms. The income of a trust only for example from renting out a house held.

Trusts can be hugely beneficial for income tax purposes in the right circumstances. Income Tax Return for Estates and Trusts for any year that a. Charitable Trusts and NGOs Tax Benefits List.

Get Access to the Largest Online Library of Legal Forms for Any State. They may benefit from. One of the tax advantages of a family trust is related to Capital Gains Tax CGT.

Ad The McCaig Mastery Trust Course Will Set the Groundwork for Your Financial Success. Learn About Tax-Exempt Trusts and How They Will Benefit You. 2022 Ordinary Income Trust Tax Rates.

North Carolinas income tax laws permitted the taxation of a trust based on the. For purposes of the organizational test when a charitable trust seeks exemption. Ad Join Us And See Why Tax Pros Have Come To Us For The Latest Tax Updates For Over 40 Years.

Trusts may be advantageous if the beneficiaries fall within a.

How A Grantor Trust Works Smartasset

Income Tax Challenges And Smart Planning For Irrevocable Trusts 1

What Are The Tax Benefits Of Trusts With Pictures

Naming A Trust As Ira Beneficiary Key Considerations Fiduciary Trust

Qualified Small Business Stock Qsbs Tax Benefit Carta

State Historic Tax Credits Preservation Leadership Forum A Program Of The National Trust For Historic Preservation

Unexpected Tax Bills For Simple Trusts After Tax Reform

Naming A Trust As Ira Beneficiary Key Considerations Fiduciary Trust

How Are Trusts Taxed Faqs Wealthspire

Getting Stretch Ira Treatment With An A B Trust

Irs Announces 2022 Tax Rates Standard Deduction Amounts And More

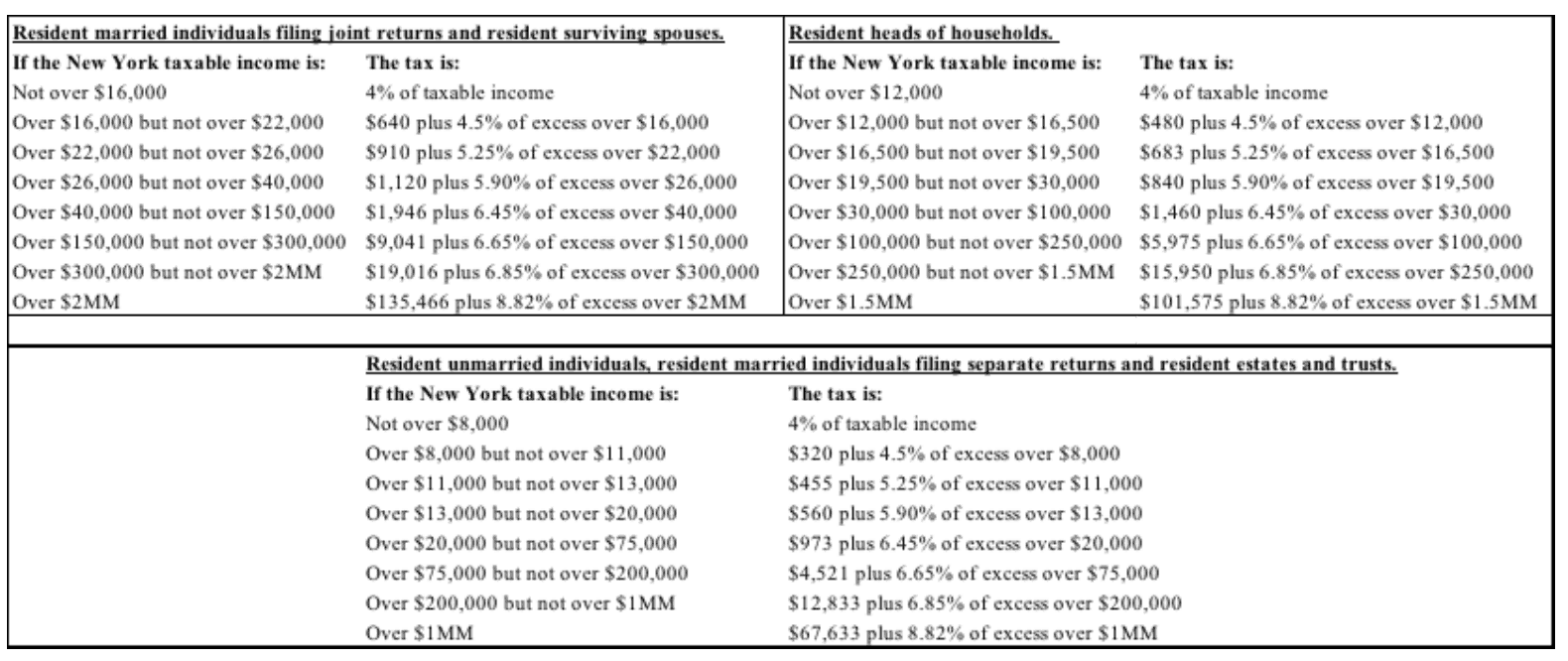

New York Resident Trust Vs An Individual Tax Rate

Financial Assistance For Families With Special Needs Children Able Act

What Is A Trust And How Does It Work Bankrate

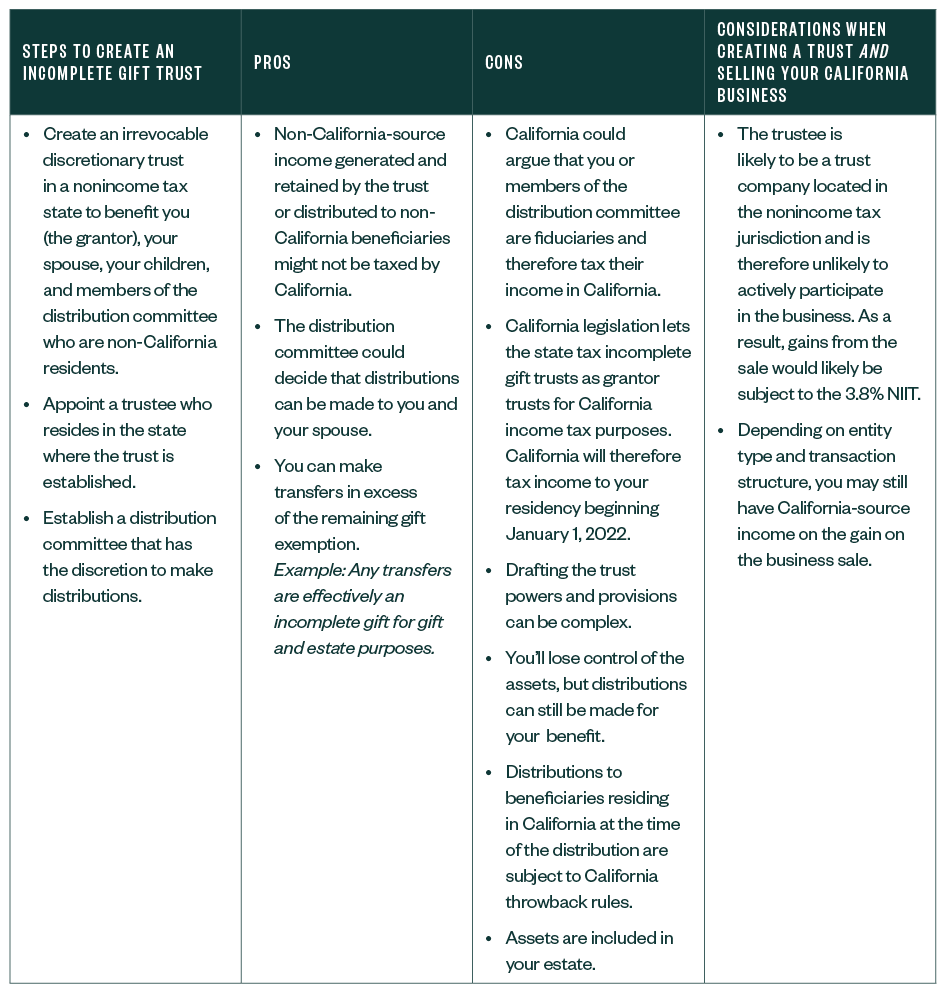

Considerations For Changing Your Residency From California

Tax Benefits Of A Family Trust

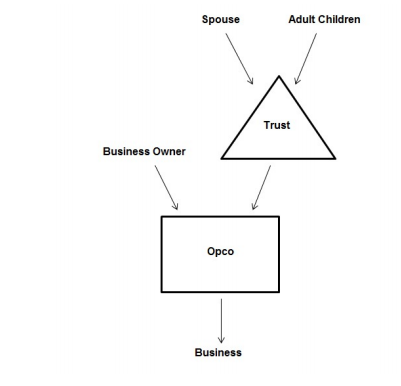

Canada S New Income Splitting Tax Rules And Family Trusts Lexology

Trusts What They Are And How To Set One Up Nerdwallet

:max_bytes(150000):strip_icc()/Form1041screenshot-69d9b8c83e054defaa28caefc685c525.png)

Form 1041 U S Income Tax Return For Estates And Trusts Guide